Big data has meant chief financial officers are investing in smart software which can increase their effectiveness and standing with the board

The explosion of data in companies has left many chief financial officers (CFOs) struggling to manage the information. The result has been a surge in finance chiefs implementing business intelligence and analytics tools to help them address the issue. But these tools bring many challenges and opportunities that are forcing CFOs to redefine their data strategies, skills and mindset.

Gartner forecasts global revenue in the business intelligence and analytics software market to grow from $18.3 billion in 2017 to $22.8 billion in 2020. Most of this (79 per cent) comes from CFOs as finance is the department that most often invests in analytics, according to Deloitte Touche Tohmatsu.

David Anderson, UK strategy and operation finance leader at Deloitte, says: “The exponential growth in analytics technologies is hitting finance and they are struggling to make sense of it, forcing CFOs to change their data strategies. We don’t expect them to become technologists, but they do need to be more tech savvy, adaptable and risk loving; a completely different mindset and profile of individual.”

But Johanna Robinson, managing vice president of finance research at Gartner, says business intelligence and analytics will enhance CFOs’ positions in their companies if they can harness the tools effectively.

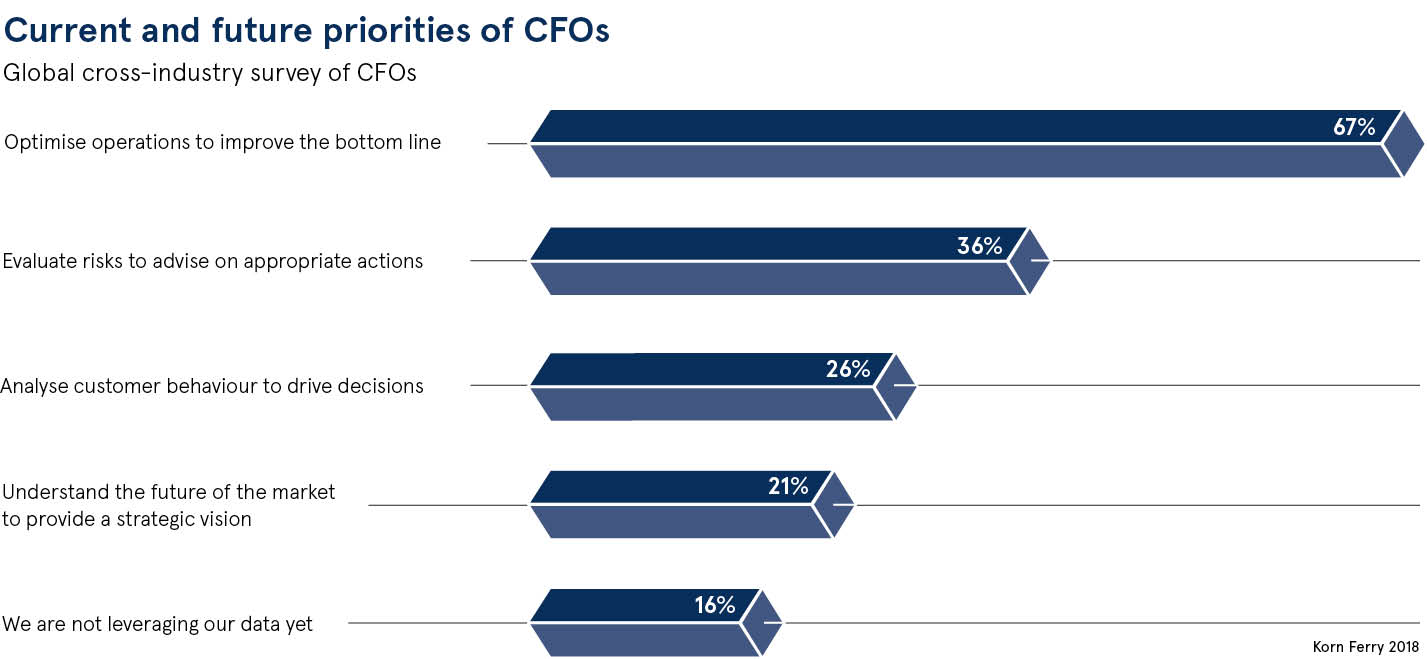

“Smarter business intelligence tools and analytics can improve profits by supporting better operational decisions, more accurate investment evaluations, and faster identification of emerging risks and opportunities,” she says.

To read more click here.